Introduction

The VWAP indicator is another of our suite of volume indicators and one which was first referred to in 1988 when it appeared in an article entitled “The Total Cost Of Transactions On The NYSE” in the March edition of the Journal Of Finance from that year, which went on to explain its importance, particularly from an institutional perspective, which underpins its significance in appreciating the power and importance of this indicator.

In many ways, it is akin to the volume price analysis methodology itself, as we are merely attempting to follow the footprints in the sand left by their passage and described by volume. The same is true here, but in this case, we are following the institutions in much the same way.

Originally, the VWAP indicator was developed as a benchmark to measure whether an institutional customer received a fair execution of their order by the broker buying and selling on their behalf. The difference between the reported price and the VWAP gave the customer a benchmark against which to judge whether they had received a fair price or not. A portfolio manager for example, wants to know how the price they paid compared to the average price of the stock during the time it took to fill the order. If an order is filled at a worse price than the VWAP, it raises questions as to the ability of the broker. If the broker purchased a million shares at $40.50 and the VWAP during this time was at $40.70, the customer is likely to be happy since they paid 20 cents less than ‘fair value’. Equally, if the stock were purchased above, at, say $40.90 per share, the customer would consider this a poor trade, paying well above the fair value price at the VWAP.

The simplicity of this easy-to-understand benchmark, which creates this fair value price concept, has led to its wholehearted adoption amongst the institutions, and moreover, why algorithmic VWAP orders now dominate institutional market activity. A huge percentage of institutional orders are executed as VWAP orders, which raises two key questions. First of all, why, and second, how can we benefit from using the indicator?

If we start with the why, according to reports from the leading market makers, almost 40% of orders are now executed on this basis as they attempt to obtain a buy or sell price close to or better than the VWAP during the time it takes to complete the buy or sell order. These orders, therefore, help to hugely reinforce the importance of the VWAP since it is the guiding principle on which these orders are based. Even Warren Buffet uses VWAP, as evidenced when he sold his entire position in Southwest Airlines over two days, holding 2.3 million shares.

This highlights the key issues for any large institutional investor involving the price. If executed in a single order, an order to buy a large block of shares would almost certainly swamp the market, raising the price exponentially and, in addition, overwhelm the average volume traded in the day.

It is this issue of putting the price up against their own buying or conversely seeing the price fall as a result of their own selling that leads to the parent and child order scenario where significant block orders are broken into a multitude of smaller orders, which are duly executed over days, weeks or months. It is this aspect of institutional order execution that makes the VWAP such a potent indicator.

However, at Quantum Trading, we don’t just build a single indicator and leave it at that! We always take them to another level, and here we have done the same, bundling together a total of five indicators into one amazing value package so you can select your favorite from those on offer. The reason for this is we recognize the different ways the volume-weighted average price is used, which is why we offer a total of FIVE variants to choose from, and these are as follows:

- VWAP – Volume Weighted Average Price

- MVWAP – Moving Volume Weighted Average Price

- AVWAP – Anchored Volume Weighted Average Price

- TWAP – Time Weighted Average Price

- Interday Volume Weighted Average Price

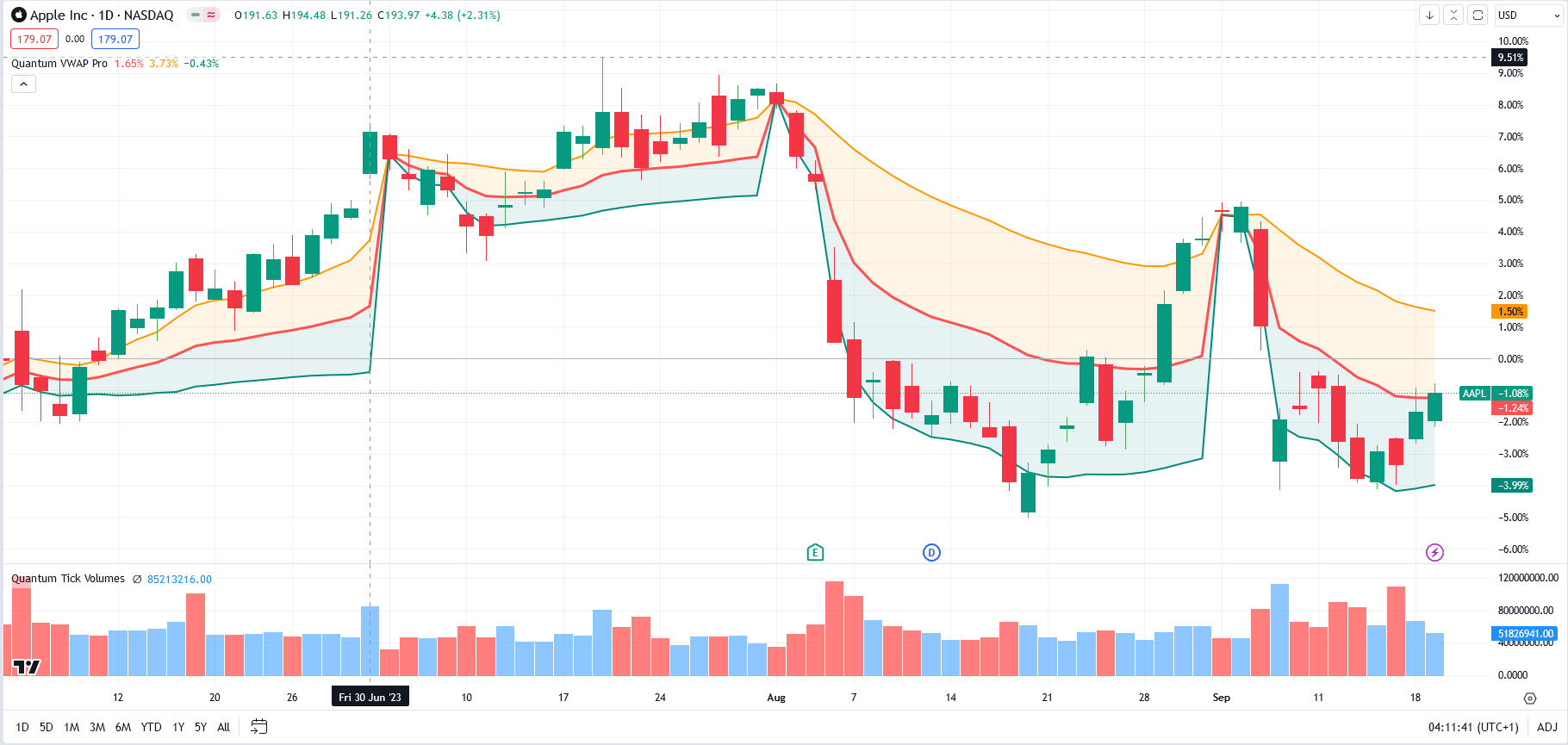

All five variants include the option to display upper and lower bands that act as envelopes above and below the VWAP based on standard deviation, which you can adjust and set yourself. These price envelopes become essential dynamic support and resistance levels, which can help predict the extremes of price action as it oscillates around the VWAP from the fastest to the slowest timeframes and everything in between.

All five indicators are packaged into one powerful indicator, which we have named the Quantum VWAP Pro indicator for obvious reasons, and as you would expect, it works in all markets and instruments, whether stocks, futures, ETFs, forex or cryptocurrencies.

Finally, as with all our indicators, we recommend you use it in multiple timeframes.

Variants

VWAP: Volume-Weighted Average Price

The VWAP or Volume-Weighted Average Price is a technical analysis tool that displays the average price of an instrument weighted by volume. It appears as a single line like a moving average but smoother. It can either be used as a dynamic support/resistance level or a “magnetic” level where price oscillates.

The “VWAP” variant of the VWAP Pro indicator calculates the volume-weighted average price of an instrument within each day and resets as it passes the last bar of the intraday period. It anchors itself at the first bar of the new day and its lines fan out in 3 directions once again, repeating the cycle. From the central VWAP line, it plots 2 additional lines or “bands” at the top and bottom and are calculated as 1 standard deviation from the VWAP line and they can be adjusted using the multiplier variable in the indicator’s user inputs.

MVWAP: Moving Volume-Weighted Average Price

MVWAP stands for Moving Volume-Weighted Average Price and is one of the variants available in the VWAP Pro indicator. It is calculated as the moving average of VWAP values within a certain length of time. In most ways, MVWAP has the same qualities as the VWAP variant, but the difference lies between sessions where there are no anchors or resets. As a result there is a continuity between time periods and sessions and because it is an average of VWAP values, you can customize it such that its length of calculation can be shortened to be made more responsive to price action or smooth out noise with longer lengths.

AVWAP: Anchored Volume-Weighted Average Price

Just as its name implies, what makes AVWAP or the Anchored Volume-Weighted Average Price unique compared to other variants is it allows you to choose the starting point of the calculation. If the basic VWAP “anchors” its calculations at the start of every daily session then the AVWAP gives you the choice where to set its singular point of origin by simply clicking a data point in the chart’s bar history. This flexibility offers great opportunities to trade news releases, announcements, candlestick patterns and other significant events that affect the market by placing the anchor at such meaningful time points.

TWAP: Time-weighted Average Price

The Time-Weighted Average Price or TWAP takes the average of the open, high, low, and close prices of a candlestick bar then averaging these further within a certain period and repeating this throughout the bar history. Unlike the other variants included in the VWAP Pro, the TWAP does not involve volume in its calculations, and it is purely based on price action, but it possesses the same elements such as a central line with upper and lower bands that run parallel to it. Due to its nature, its shape when laid on the chart appears to conform more tightly to price action. This offers an additional perspective to the VWAP Pro’s other volume-based variants. TWAP is unbiased in terms of volume and so for high-volume traders, TWAP is a great tool for placing large trades by breaking them into smaller orders that are executed over regular intervals near the TWAP value so as not to cause adverse effects on the market. For regular traders, it gives a useful perspective to the market’s price action especially in faster timeframes while coupled with VWAP Pro’s volume-based variants.

Interday VWAP: Interday Volume-Weighted Average Price

The Interday VWAP variant offers new trading opportunities to long term investors by scaling up the basic VWAP variant’s calculations from within daily sessions to longer timeframes. If VWAP traditionally anchors or resets its calculations at the beginning of the day, then the Interday VWAP variant anchors at longer periods which can be adjusted to something that suits the timeframe you are trading. You can choose to make the calculations span in Weekly, Monthly or Yearly intervals. This mode is also useful to short-term traders to check their trades to see whether they are riding the market’s overarching trend. It provides precious information on the look ahead showing how price action potentially plays out in the bigger picture.

Settings

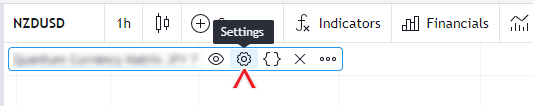

The Settings button appears as a small cog/gear icon beside the name of the indicator at the chart. Clicking the button shows a dialog box for configuring the Inputs and Style options.

Inputs

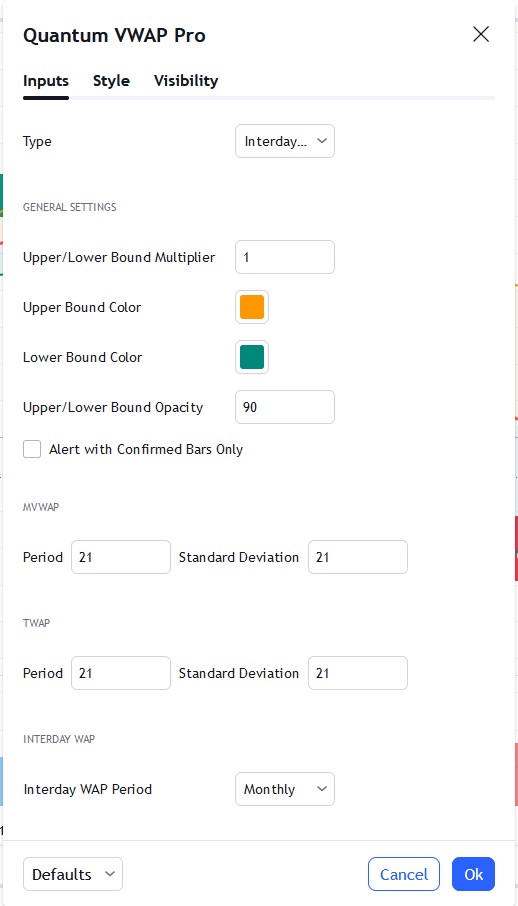

Type

Sets which variant of the weighted average price is used. There are 5 options:

- AVWAP – Anchored Volume Weighted Average Price (the default type)

- VWAP – Moving Volume Weighted Average Price

- MVWAP – Anchored Volume Weighted Average Price

- TWAP – Time-weighted Average Price

- InterdayVWAP – Interday Volume Weighted Average Price

Upper/Lower Bound Multiplier

This value is factored with the value of the upper and lower bound lines and by changing it, you can adjust the proximity of these lines from the main VWAP line. It also accepts decimal values as multipliers like 0.5 and 0.25.

WAP Line Color

Sets the color of the main line plot. (the center line)

Upper Bound Color

Sets the color of the upper bound line plot.

Lower Bound Color

Sets the color of the lower bound line plot.

Upper/Lower Bound Opacity

Sets the transparency of the upper and lower bound plots to adjust their visual impact on the chart.

Alert with Confirmed Bars Only

If this setting is enabled, alerts are not triggered by signals on the open/forming bar. All bars that meet the condition must be closed to trigger an alert.

MVWAP > Period

As explained above, MVWAP is a moving average of VWAP values across a certain look back period. This setting is the number of bars that the indicator uses to get the average VWAP values to create the MVWAP line.

MVWAP > Standard Deviation

The upper and lower bound lines of the MVWAP use their own look back period which references this setting. Its default value matches its MVWAP Period which we find is the best starting point.

TWAP > Period

Like the MVWAP variant, the TWAP is also a moving average, but an average of OHLC prices across a certain look back period. This setting allows you to change the number of bars it takes in its calculation of the TWAP.

TWAP > Standard Deviation

The upper and lower bound lines of the TWAP also use their own look back period and reference this setting. Its default value matches its TWAP Period which we find is the best starting point.

Interday VWAP > Interday WAP Period

This setting refers to the time intervals that the VWAP Pro indicator will use when it is in Interday VWAP mode. There are 3 periods to choose from:

- Weekly – recommended when using Interday VWAP in a Daily timeframe

- Monthly – recommended when using Interday VWAP in Daily, multiple days, or weekly timeframe

- Yearly – recommended when using Interday VWAP in Monthly timeframe

AVWAP > AVWAP Start Date/Time

Sets the date and time of the AVWAP’s anchor or the starting point of its calculation.

TradingView offers an easier method to adjust the AVWAP’s anchor through a draggable knob that appears when you select the VWAP Pro indicator’s plot or when you open its Settings window. The knob is shown as a white box with blue outline and a vertical strike through line that helps align itself in the chart’s x-axis. Once visible, you can click and drag the box sideways to set the anchor date/time. The AVWAP will automatically recalculate from the selected anchor point.

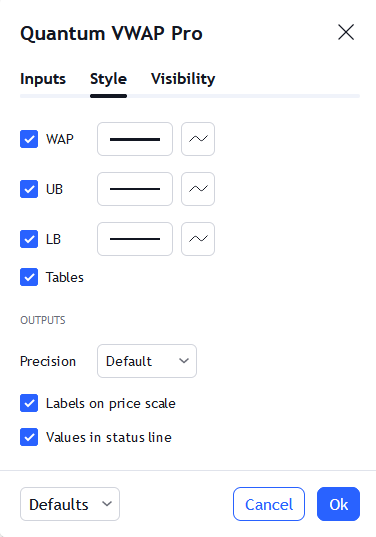

Style

WAP

This line is the main plot of the indicator which could be any of the 5 weighted-average price types depending on the value of the Type input.

- You can hide or display the WAP line using the checkbox.

- You can customize the color, opacity, and thickness of this plot by clicking the color box. The default color is red, and the thickness is set to 3.

- The second box allows you to change the plot type and enable the Price Line. The Price Line is a horizontal line that keeps track of the plot’s current value. Changing the plot type is not recommended.

UB

This plot represents the upper bound of the WAP line.

- You can hide or display the UB line using the checkbox.

- Its color is set by the Upper Bound Color setting in the Inputs tab, and the default thickness is set to 2.

- The second box allows you to change the plot type and enable the Price Line. The Price Line is a horizontal line that keeps track of the plot’s current value. Changing the plot type is not recommended.

LB

This plot represents the lower bound of the WAP line.

- You can hide or display the LB line using the checkbox.

- Its color is set by the Lower Bound Color setting in the Inputs tab, and the default thickness is set to 2.

- The second box allows you to change the plot type and enable the Price line. The Price Line is a horizontal line that keeps track of the plot’s current value. Changing the plot type is not recommended.

Tables

This option shows/hides the table object used by the indicator. Please keep this option enabled.

Precision

This determines the number of decimal places the indicator uses to display the current value of its plots. You can adjust this by choosing from a drop-down list.

Labels on price scale

This option shows/hides the current value of the plots in the price axis.

Values in status line

This option shows/hides the current value of the plots beside the indicator label/name while it is active on the chart.

Alerts

The VWAP Pro indicator has a total of 6 alert conditions

Crosses

Alert Conditions

- VWAP Cross Over

- VWAP Cross Under

- Upper Band Cross Over

- Upper Band Cross Under

- Lower Band Cross Over

- Lower Band Cross Under

Condition

Triggers when price crosses the VWAP line, Upper Band, or Lower Band. The alert message includes the direction of the intersection whether it is over or under.

Alert message

Examples:

The following alert messages are used respectively with the corresponding Alert Conditions above

- {Chart instrument} at {current Close price} CROSSED OVER VWAP at {current price level of VWAP}

- {Chart instrument} at {current Close price} CROSSED UNDER VWAP at {current price level of VWAP}

- {Chart instrument} at {current Close price} CROSSED OVER UPPER BAND at {current price level of Upper Band}

- {Chart instrument} at {current Close price} CROSSED UNDER UPPER BAND at {current price level of Upper Band}

- {Chart instrument} at {current Close price} CROSSED OVER LOWER BAND at {current price level of Lower Band}

- {Chart instrument} at {current Close price} CROSSED UNDER LOWER BAND at {current price level of Lower Band}