Overview

The Currency Array indicator has been developed to measure and display quickly and easily, the speed at which currency pairs are rising and falling. Just like the Quantum Currency Matrix, the Quantum Currency Array indicator displays the complete array of 28 currency pairs derived from the 8 major currency pairs as featured in the Quantum Currency Strength Indicator (CSI):

- US Dollar

- Euro

- British Pound

- Swiss Franc

- Japanese Yen

- Canadian Dollar

- Australian Dollar

- New Zealand Dollar

In displaying all the pairs in an array this gives an instant view of the relative trend strength and displays this relationship in a visual and intuitive manner in three ways. Each one shows a different perspective and insight into the complex world of currency strength concepts.

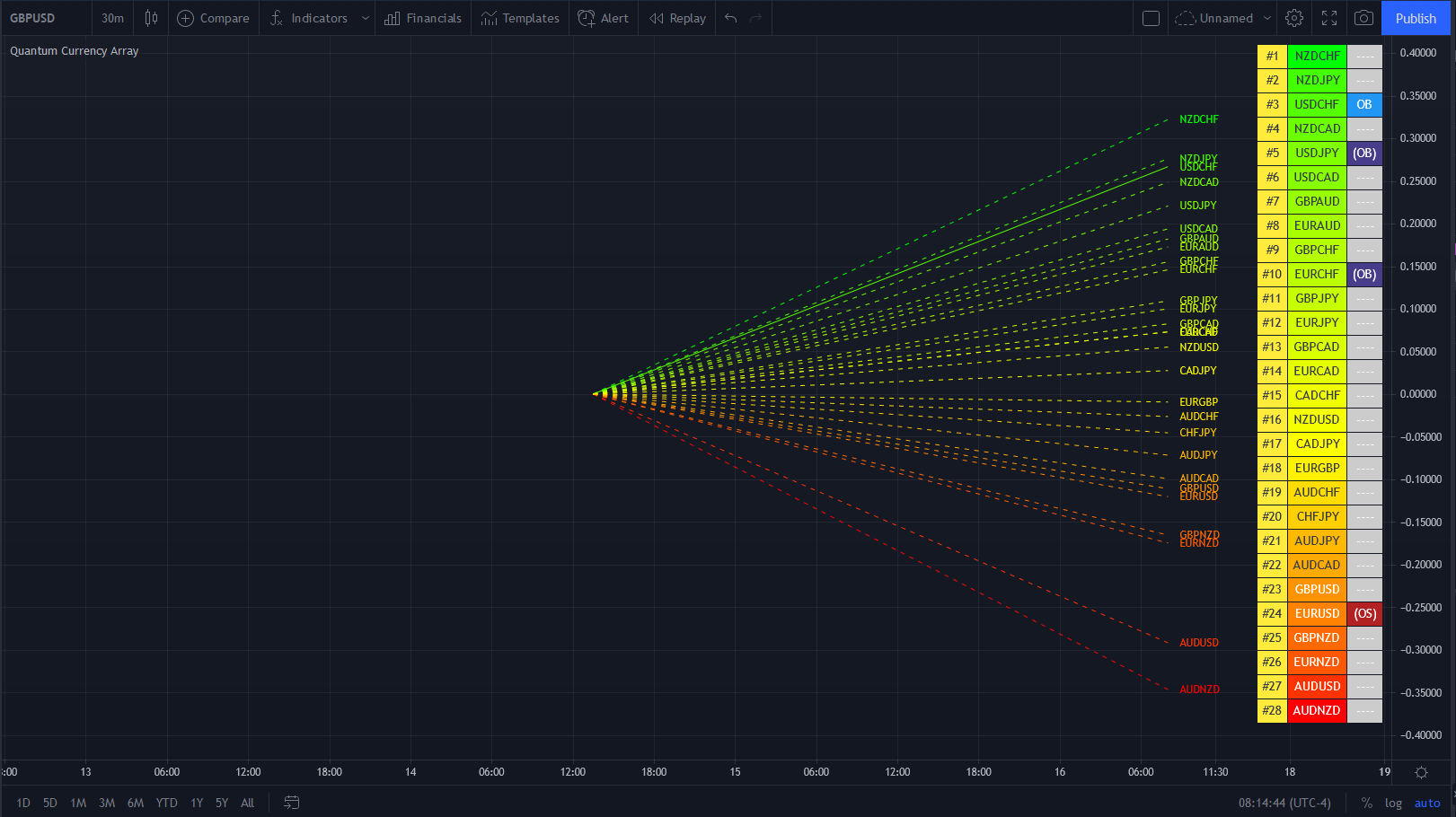

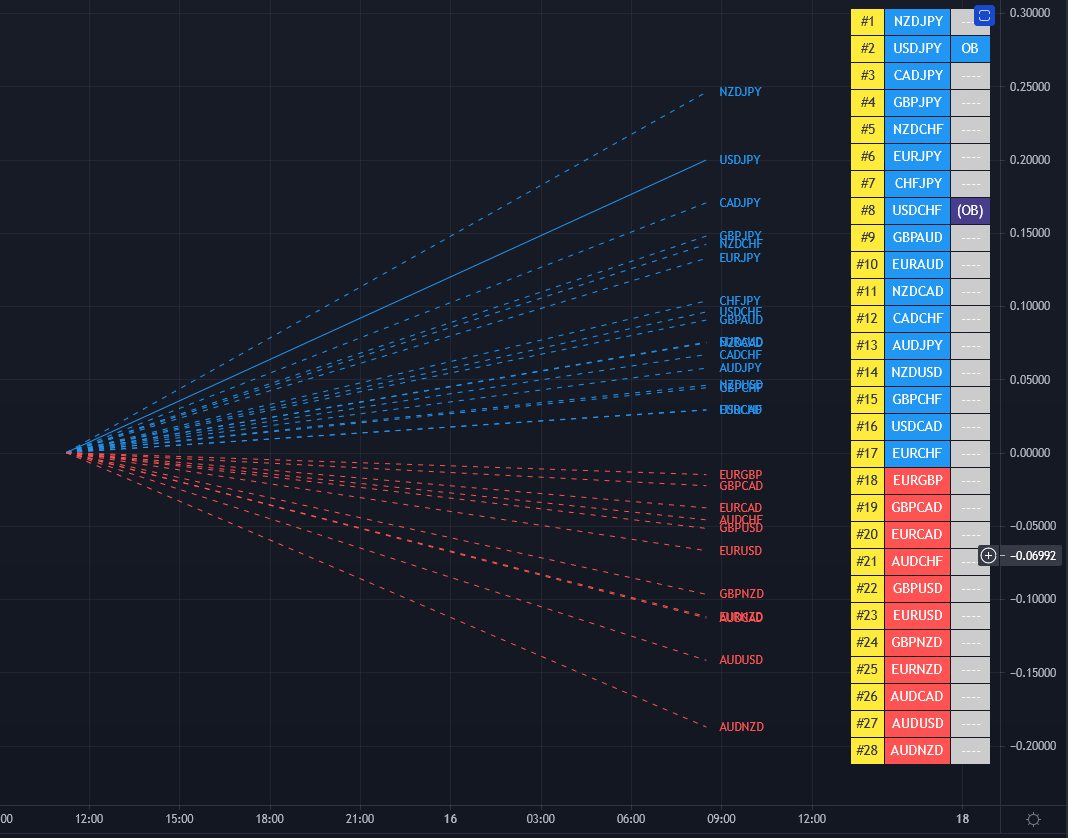

Ranked list

First, the indicator displays 28 major currency pairs in a ranked list ordered by the strength of the trend. The currency pair with the greatest momentum and steepest uptrend appears at the top of the list while the one with the greatest momentum and steepest downtrend appears at the bottom. All the other pairs are then ranked accordingly, and color coded from red at the bottom, to yellow and into green at the top of the ranking table. Currency pairs in congestion appear in the middle of the table.

In the ranked list, alongside the ranks of currency pairs is a second column that provides signals as to whether a particular currency pair is approaching an overbought or an oversold state. These are then signaled in two ways. First a signal the currency pair is approaching such a state, and second when it has arrived in this condition. These are coded as follows:

- (OB) – This signal appears as a dark shade of blue which means that the currency pair is APPROACHING an OVERBOUGHT state.

- OB – This signal appears as a bright shade of blue which means that the currency pair is IN an OVERBOUGHT state.

- (OS) – This signal appears as a dark shade of red which means that he currency pair is APPROACHING an OVERSOLD state.

- OS – This signal appears as a bright shade of red which means that the currency pair is IN an OVERSOLD state.

Once any of these signals appears beside a currency pair, it indicates the potential change in direction of the trend, which can then be considered further by analysis of the chart. For example, if the EURGBP is seen at the very top of the list and beside it is an OB signal, it means that although the uptrend is seemingly strong, the bullish strength driving it may be reaching an exhaustion point, starting to diminish with a possible change in direction in due course.

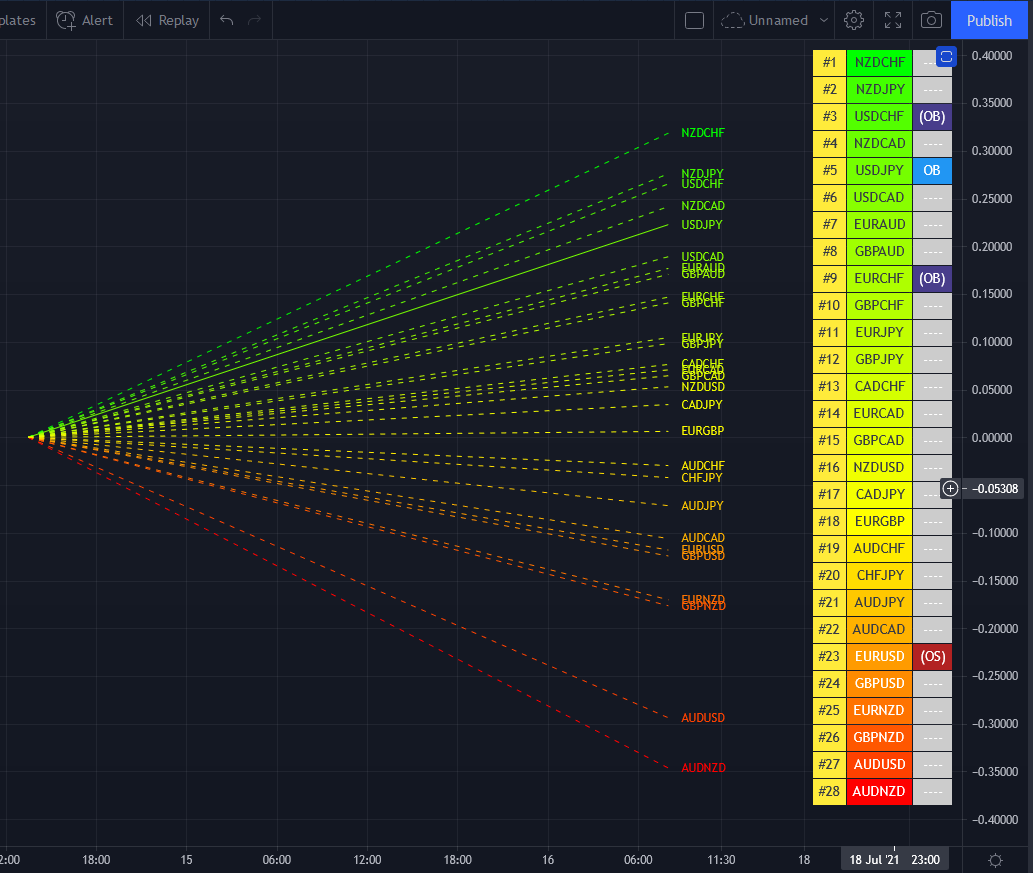

Currency Array

Secondly, it displays the same 28 major currency pairs as lines in a graph that diffuse out into the array and with varying magnitudes depending on the strength and inclination of each currency pair’s trend. This means the order in which they appear vertically follows the same ranking in the table alongside, but as a graphical display, instantly, visually and numerically revealing the actual steepness of each currency pair’s trend. As you would expect the currency pair with the fastest and steepest uptrend also has the steepest UPWARD line in the graph. Likewise, the fastest and steepest downtrend also has the steepest DOWNWARD line in the graph. Currency pairs with the least steepness in their trend (and in congestion) are found closest to the 0 level of the graph and appear horizontal.

You can also see each line in the array has one of 2 different line styles. Its style depends on the state of its corresponding currency pair as defined above.

- Dashed – This means the currency pair is trending, but not close to an overbought or oversold condition.

- Solid – This means the currency pair is at an overbought or oversold condition.

One of the most powerful features of the array when watching trends develop in real time is not only considering one pair, but how pairs move together ‘en masse.’ This can give you huge confidence when taking a position in the market, as you will see all the currency pairs for that complex “marching together” stretching higher or stretching lower and reflecting market sentiment for that currency and its associated pairs. This is immensely powerful, and will give you the confidence, not only to take a position, but then to hold it to maximize your profits from the trend.

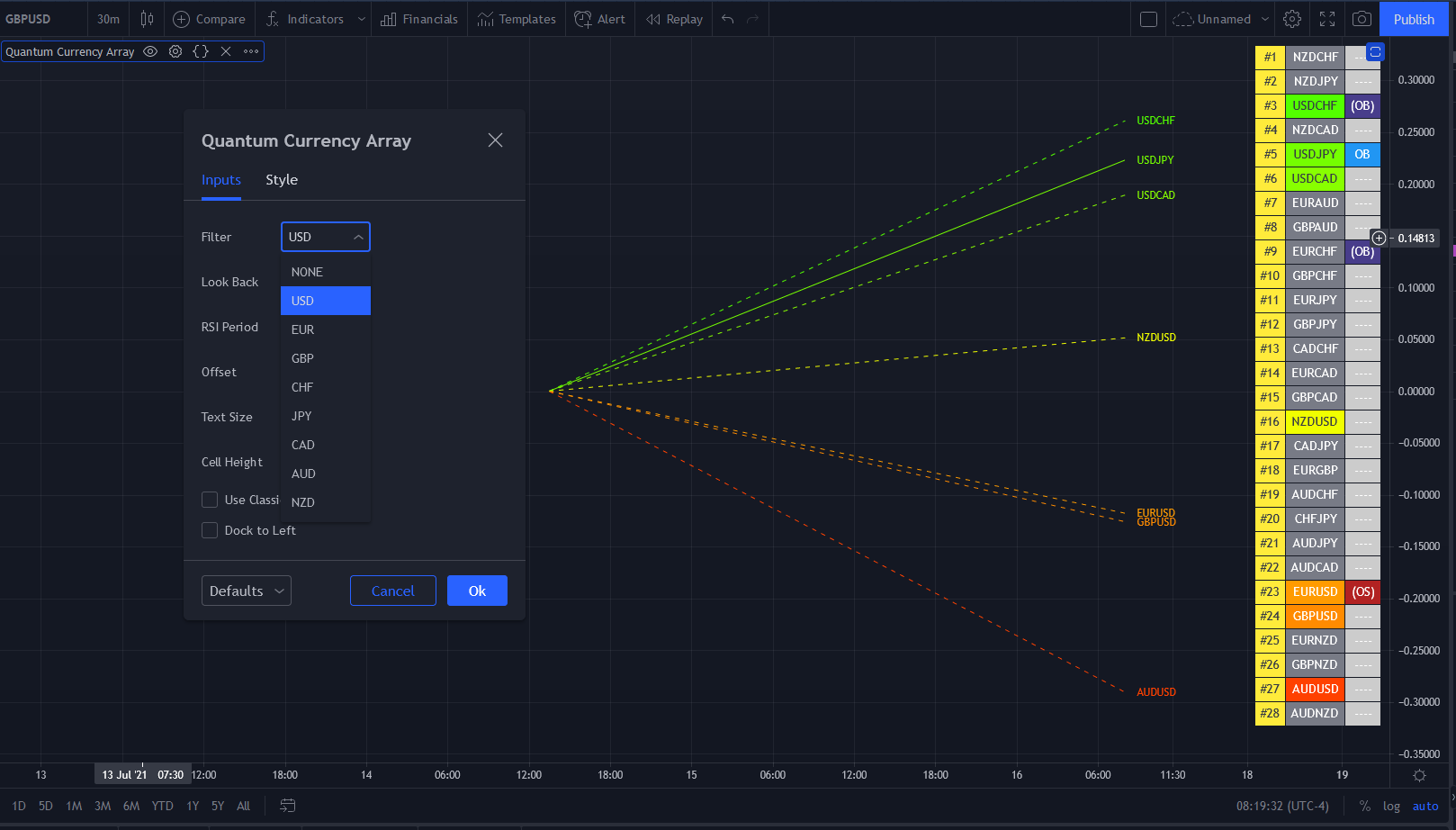

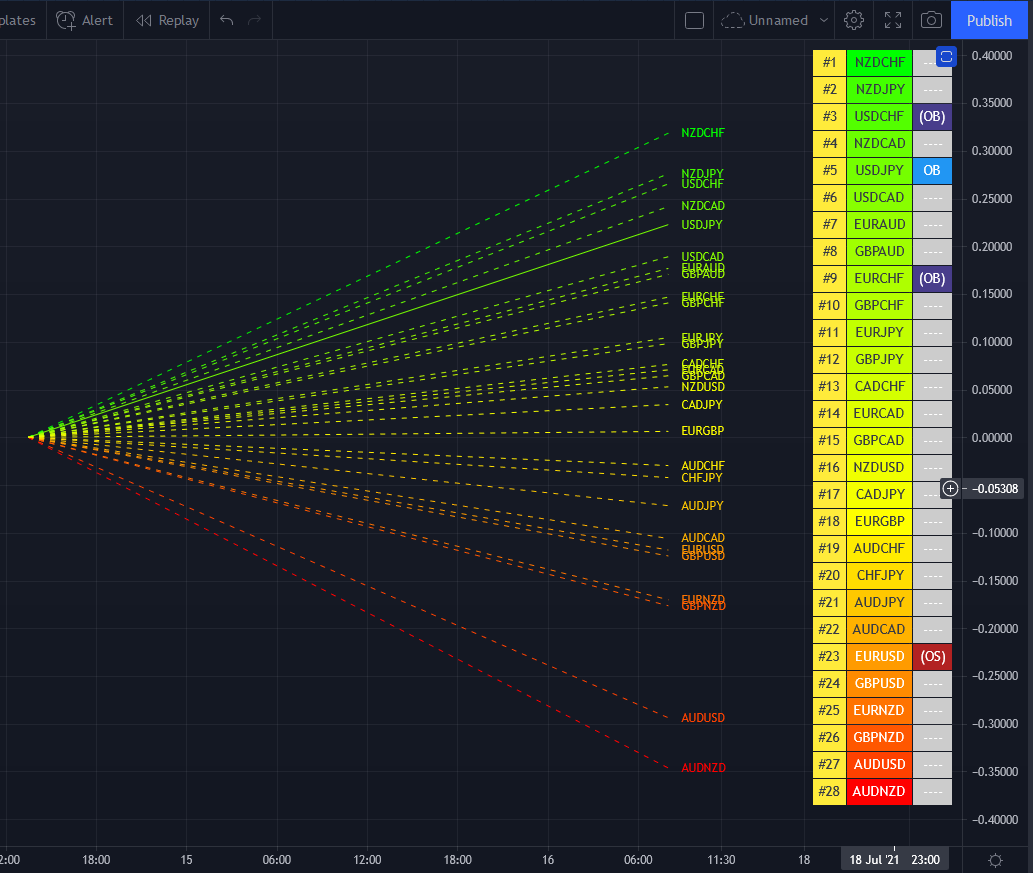

Currency filter

The Currency Array indicator allows you to filter the currency pairs relevant to the currency you are analysing. Just like the Quantum Currency Matrix indicator, an input is provided in the indicator settings window which you can click to select a currency.

- USD selects all currency pairs that contain the US Dollar.

- EUR selects all currency pairs that contain the Euro.

- GBP selects all currency pairs that contain the British Pound.

- CHF selects all currency pairs that contain the Swiss Franc.

- JPY selects all currency pairs that contain the Japanese Yen.

- CAD selects all currency pairs that contain the Canadian Dollar.

- AUD selects all currency pairs that contain the Australian Dollar.

- NZD selects all currency pairs that contain the New Zealand Dollar.

Click the Filter option box and select a currency in the list to apply a filter. If you like to undo a filter, simply select NONE. When a certain currency filter is in effect, the currency pairs that include the selected currency in the table appear in color. Meanwhile, all currency pairs that include the selected currency in the array are the only ones displayed.

Divergence

And this leads on to the third aspect of the Currency Array indicator which is this – it will give you an instant heads-up to divergence across a currency complex, and the easiest example here is with the Japanese yen which is the counter currency for the major and cross pairs. On the array we should expect to see all the currency pairs on one side of the mid point or the other. After all, if the flow of sentiment for the Yen is universal, then we would expect to see all the currency pairs aligned accordingly, whether selling or buying the Japanese Yen. If not, then we have some divergence, and the flow of sentiment is not universal. If you are trading a pair which is perhaps counter to broad sentiment, then this is a high risk proposition. The Currency Array will tell you this instantly and visually and across all the timeframes with a single click and on ONE chart. No need to try to scan 28 charts. It is all here for you.

Dynamic graded color coding

One of the coolest features we have introduced across all our indicators is the dynamic graded color coding, found in both the ranked list and the graph which makes analysis intuitive and fast. You can probably see instantly just from the images how easy it is, but here is a walkthrough.

The currency pairs appear as a color in the range of a green-yellow-red gradient (in that order). Simply put, the color of each currency pair varies depending on its value, in this case the steepness of the trend:

- Green shades – the steepness of the currency pair’s trend is positive and is well above the fulcrum of zero.

- Yellow shades – the steepness of the currency pair’s trend is relatively flat and around the fulcrum of 0. It can either be positive or negative but trails the numbers closest to 0.

- Red shades – the steepness of the currency pair’s trend is negative and is well below the fulcrum of zero.

The same color gradation applies on the array itself. It is important to note the yellow levels are not precisely in the middle of the list (rank 14 of 28). The gradation of color is dynamic and hence the transition of colors will depend entirely on the steepness of the trend of each currency pair as explained above. As with all our other indicators, this is dynamic and is constantly shifting in real time to reflect the ebb and flow of sentiment across the timeframes.

Getting Started

Here are some further details on the Currency Array indicator to help you get started:

- Your Quantum Currency Array indicator can be applied to any chart for any currency pair. The chart does not influence or affect the appearance or performance of the indicator. For example you can apply the indicator to a EURUSD, a GBPUSD, or a USDCHF, or any other pair. The indicator will display in an identical way on each chart.

- The indicator occupies its own indicator window in the chart. We recommend expanding the indicator vertically to get a complete view.

- The indicator works in all timeframes.

- When you first apply the indicator, please allow a few seconds for the data to build in history.

Currency Dashboard

By itself, the Quantum Currency Array indicator is a powerful trading tool for identifying trading opportunities, quickly, easily, and on ONE chart. However, it was developed as part of what we like to call the Quantum Currency Dashboard which consists of the following indicators:

- Quantum Currency Strength Indicator (CSI)

- Quantum Currency Matrix

- Quantum Currency Array

- Quantum Currency Heatmap

These four indicators then provide a unique and compact insight into all the various aspects of strength and weakness for both currencies and currency pairs, from trend and momentum to overbought and oversold. What is unique is that using four charts, you are then able to monitor the myriad combinations of strength, weakness, momentum, congestion and divergence across the entire forex complex at a click of a button. And even more powerfully, giving you the confidence to get in and stay in for maximum profits. No more missed opportunities, no more struggling with multiple charts, and no more trader regret, whatever your trading style or approach.

Settings

The Settings button appears as a small cog/gear icon beside the name of the indicator at the chart. Clicking the button shows a dialog box for configuring the Inputs and Style options.

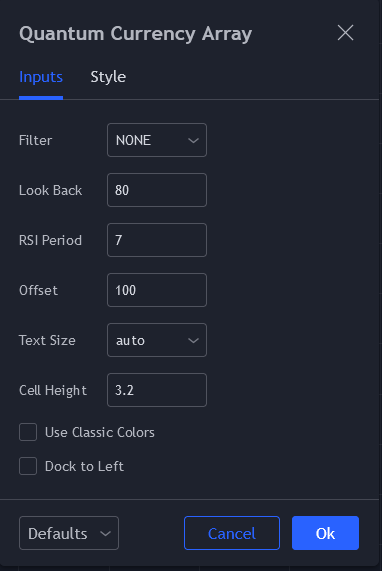

Inputs

Filter

The Filter input is an option box that allows you to select 1 of the 8 major currencies that you like to highlight in the indicator. The currency pairs that include the selected currency will appear in color while the others turn grey. In the array, only lines of currency pairs that contain the selected currency will be displayed while the others are hidden. Selecting NONE will revert to the default setting.

Look Back

This input allows you to set the period that the indicator uses to analyze the trend strength of the currency pairs. It represents the number of bars that has passed within the current timeframe. The default setting is 80 bars.

RSI Period

This setting controls the period of the indicator’s internal RSI which determines whether a currency pair is overbought or oversold.

Offset

This input controls the position of the indicator in the chart window. The default is 100 bars to the left of the chart.

Text Size

This input sets the font size of the indicator and you can choose from the following options: auto, tiny, small, normal, large huge. The default value is auto which means that the text adapts to the size of the cell.

Cell Height

This input defines the height of each cell in the table and therefore, the entire indicator as well. You can decrease its value if the indicator is too large for your screen or increase its value if you have plenty of space in your screen. The default value is 3.2. You can set this input to 0 to allow each cell to adjust to the size of the text automatically.

Use Classic Colors

Instead of using a green-red gradient, the indicator switches to a dual color scheme when this input is ticked. When using classic colors, all currency pairs with a positive score are blue while the negative ones are red.

Dock to Left

You can enable this input option to change the position of the indicator from the right side to the left side of the chart.

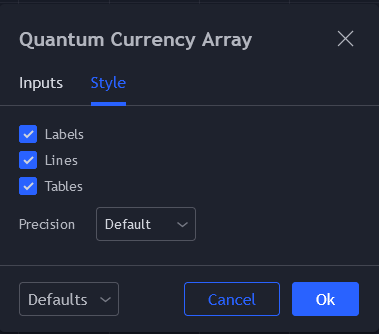

Style

Labels

This option sets the visibility of the Label objects created by the indicator. We strongly advise that you keep this option enabled to ensure that the table of currency pairs is always displayed.

Lines

This option sets the visibility of the Line objects created by the indicator. We strongly advise that you keep this option enabled to ensure that the array is always displayed.

Tables

This option shows/hides the table object used by the indicator. Please always keep this option enabled.

Precision

This setting have no effect in the indicator’s output.

Alerts

The Currency Matrix indicator has a total of 56 alert conditions.

Overbought

Alert Conditions

- EURUSD Overbought

- GBPUSD Overbought

- USDCHF Overbought

- USDJPY Overbought

- USDCAD Overbought

- AUDUSD Overbought

- NZDUSD Overbought

- EURGBP Overbought

- EURCHF Overbought

- EURJPY Overbought

- EURCAD Overbought

- EURAUD Overbought

- EURNZD Overbought

- GBPCHF Overbought

- GBPJPY Overbought

- GBPCAD Overbought

- GBPAUD Overbought

- GBPNZD Overbought

- CHFJPY Overbought

- CADCHF Overbought

- CADJPY Overbought

- AUDCHF Overbought

- AUDJPY Overbought

- AUDCAD Overbought

- AUDNZD Overbought

- NZDCHF Overbought

- NZDJPY Overbought

- NZDCAD Overbought

Condition

Triggers when the currency pair is has an overbought “OB” signal (does not trigger at “(OB)” signal)

Alert message

Examples:

- Overbought at EURUSD

- Overbought at GBPCHF

- Overbought at CADJPY … and so on

Oversold

Alert Conditions

- EURUSD Oversold

- GBPUSD Oversold

- USDCHF Oversold

- USDJPY Oversold

- USDCAD Oversold

- AUDUSD Oversold

- NZDUSD Oversold

- EURGBP Oversold

- EURCHF Oversold

- EURJPY Oversold

- EURCAD Oversold

- EURAUD Oversold

- EURNZD Oversold

- GBPCHF Oversold

- GBPJPY Oversold

- GBPCAD Oversold

- GBPAUD Oversold

- GBPNZD Oversold

- CHFJPY Oversold

- CADCHF Oversold

- CADJPY Oversold

- AUDCHF Oversold

- AUDJPY Oversold

- AUDCAD Oversold

- AUDNZD Oversold

- NZDCHF Oversold

- NZDJPY Oversold

- NZDCAD Oversold

Condition

Triggers when the currency pair is has an oversold “OS” signal (does not trigger at “(OS)” signal)

Alert message

Examples:

- Oversold at EURUSD

- Oversold at GBPCHF

- Oversold at CADJPY … and so on